The launch of spot exchange-traded funds (ETFs) tracking Dogecoin in the United States was met with muted enthusiasm. Inflows into the Grayscale and Bitwise ETFs were limited in their first week of trading, despite the hype around the first ever Dogecoin ETFs. But even as ETF inflows fall, some technical analysts argue that they are DOGE it can still come at a high price rise, possibly as high as $1, if important support levels hold.

Related reading

Spot DOGE ETFs on a slow start

When Grayscale rolled out his Spot DOGE fund (GDOG) on November 24, the inflow volume was about 1.8 million USD on the first day, far below estimates some market participants predicted. For example, Eric Balchunas, senior ETF analyst at Bloomberg, predicted that the ETF will witness a volume of $12 million on the first day of trading.

According to data from SoSoValuenet inflows through the DOGE ETFs Grayscale and Bitwise added to just over $2.16 million during the initial week of trading. This shows that institutional and retail investors are somewhat cautious when it comes to investing in meme cryptocurrency.

This contrasts with the strong initial inflows of other altcoin ETFs, such as those for Solana (SOL) and XRP which have been launched in the past few weeks. Furthermore, weak uptake has raised doubts about whether ETFs will spark the kind of renewed interest in DOGE that some backers had hoped for.

Technical outlook suggests bullish potential at $1

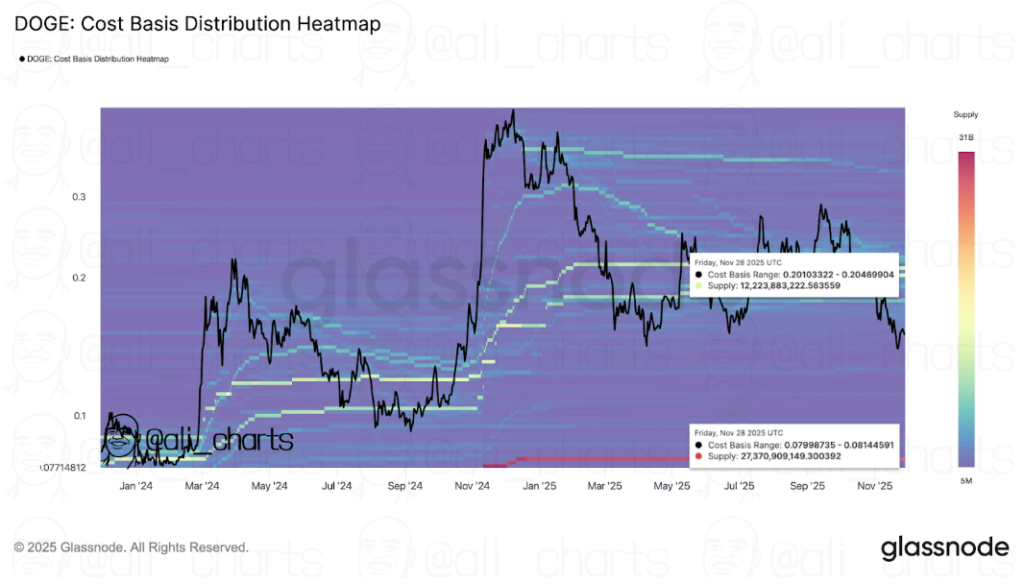

While demand for the ETF is currently tepid, a number of technical outlooks point to a potentially more bullish outcome for Dogecoin. One technical appearance from crypto analyst Ali Martinez identifies key support at roughly $0.08, with resistance around $0.20. This support level goes back to when DOGE fell below $0.10, before embarking on a multi-month rally to $0.50 after the US election.

Dogecoin key price levels. Source: @ali_charts On X

More bullish, multi-week caused a technical failure crypto analyst XForceGlobal suggests that DOGE may be ending a long-term corrective phase and positioning itself for a fifth wave, which is a strong upward impulse according to Elliott wave theory. That wave could push prices well above current levels, with potential intermediate targets between $0.33 and $0.50, and a longer-term stretch to $1.

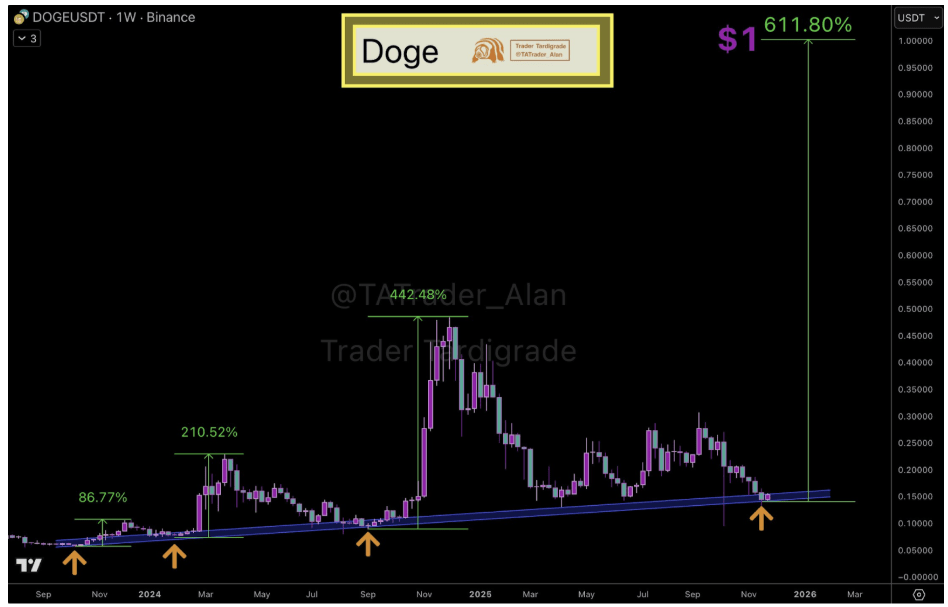

Crypto analyst Trader Tardigrade believes the same Dogecoin has fallen to the same long-term support zone that had previously led to major rallies, calling it the launch pad for the next big move. Its weekly chart highlights how Dogecoin’s price action has repeatedly bounced off this uptrend line, producing gains of over 80%, 210% and even over 440% since October 2023.

Dogecoin Technical Analysis. Source: @TATrader_Alan On X

The analyst says the pattern is intact again and if the support at $0.15 holds, Dogecoin could follow the same structure in a larger expansion phase. Based on his projection, that continuation would give Dogecoin enough momentum for a gradual 610% climb to $1 by 2026.

Related reading

At the time of writing, Dogecoin is trading at $0.15 and is close to a bounce or break below support.

Featured image from Unsplash, chart from TradingView