After a day of intense bearishness, the price of Bitcoin seems to be entering a calmer state, as it recovers above the $86,000 level. The latest on-chain data shows that several investors tried to take some profits in the past week, providing the basis for the top cryptocurrency to post a double-digit loss.

Bitcoin exchange inflows rise as price faces downward pressure

In a recent post on social media platform X, crypto analyst Ali Martinez discovered that significant amounts of Bitcoin were sent to centralized exchanges last week. Data from Santiment shows that around $20,000 worth of BTC (worth nearly $2 billion) has been transferred to these exchanges in the past seven days.

Related reading

A relevant metric in this on-chain observation is the Exchange Inflow metric, which tracks the amount of assets (in this case, Bitcoin) flowing into centralized exchanges within a given period. This metric is often important because one of the service offerings of prominent exchanges is sales.

Therefore, an increase in the Exchange Inflow metric suggests a potential offloading of assets by investors. The resulting increased supply of this cryptocurrency on the open market often increases the downward pressure on the coin’s price, especially if there is no corresponding increase in demand.

In a separate post on X, CryptoQuant’s head of research, Julio Moreno, divided piece of data that supports the recent spike in exchange inflows. According to data highlighted by the crypto researcher, Bitcoin exchange inflows were around 81,000 BTC (the highest level seen since mid-July) on Friday, November 21.

Ultimately, this recent spike in exchange inflows explains the volatility experienced by the Bitcoin price on Friday. The leading cryptocurrency succumbed to significant bearish pressure, seeing its price drop to just above $80,000 as the weekend approached.

At the time of writing, the price of BTC is around $86,070, reflecting a jump of over 2% in the last 24 hours.

Bitcoin in the profit phase: CEO of CryptoQuant

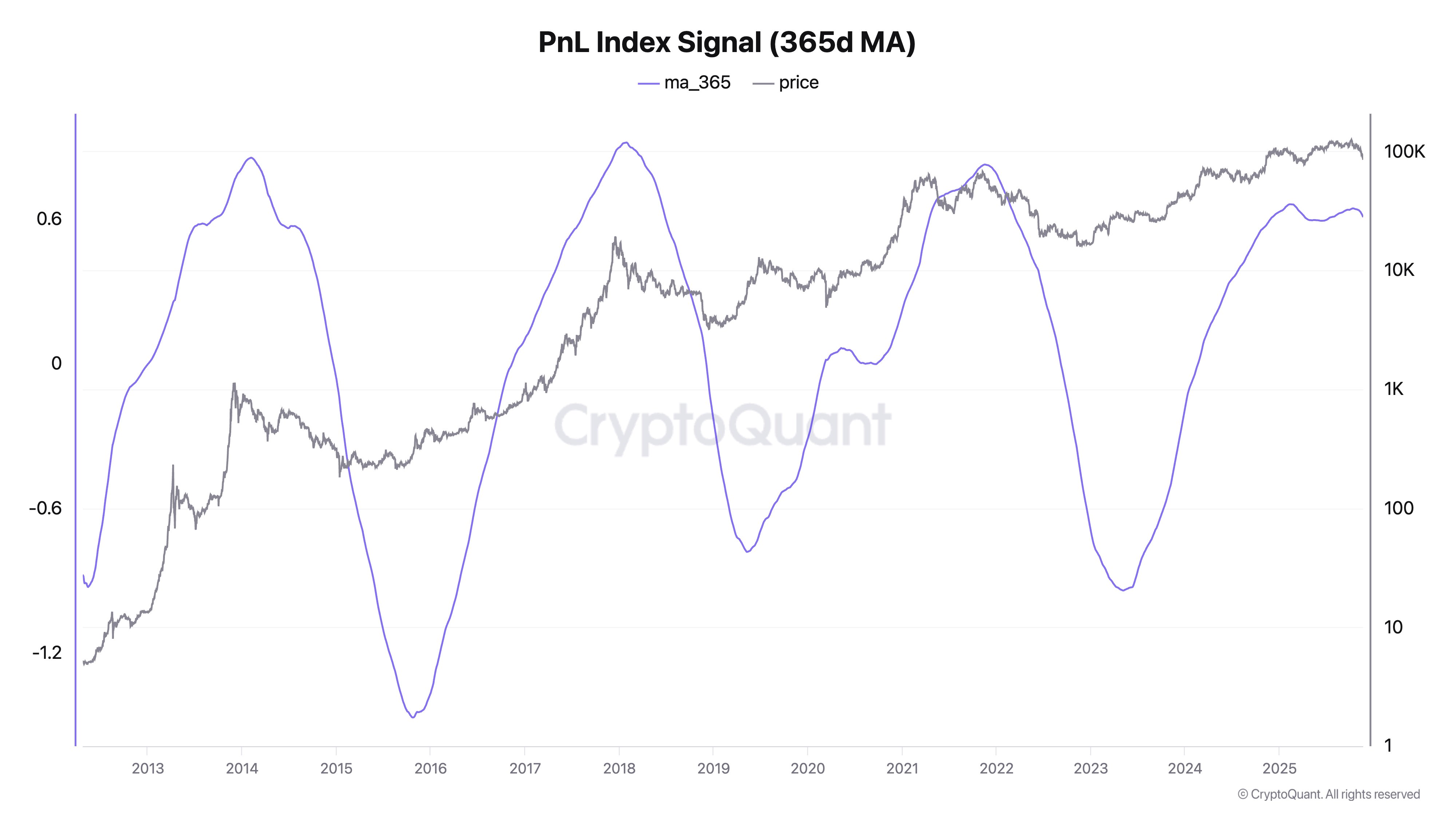

CryptoQuant CEO Ki Young Ju discovered that Bitcoin is in the profit-making phase, as evidenced by the ever-increasing inflow of the exchange rate. The cryptocurrency founder made this claim based on the PnL Index Signal, which measures profit and loss levels using the cost basis of all wallets.

With the current reading of the PnL index signal, Ju declared that classical cycle theory says that BTC is entering a bear market. According to CryptoQuant’s CEO, only macro liquidity can override the profit-taking cycle – just like we saw in 2020.

Therefore, all eyes will be on the meeting of the Federal Open Market Committee (FOMC) in December, especially given the diminishing expectations of interest rate cuts by the US Central Bank (Fed).

Related reading

Featured image from iStock, chart from TradingView