On-chain analytics firm CryptoQuant has revealed how selling by US Bitcoin investors dominated during the recent market downturn.

Bitcoin Coinbase Premium Gap Indicates US Selloff

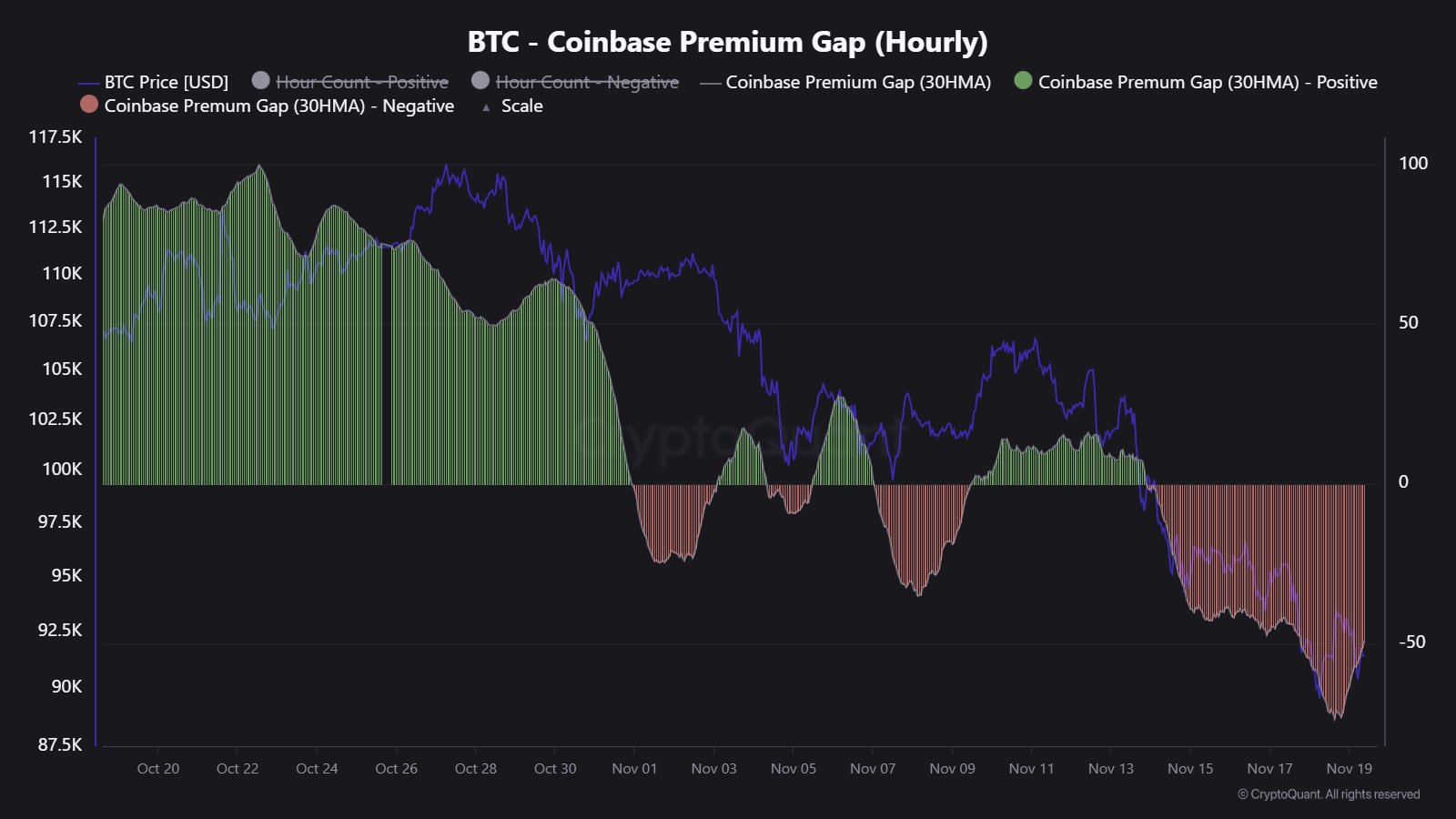

In the new one thread at X, CryptoQuant discussed some key data related to the US-dominated Bitcoin selloff. The first indicator that CryptoQuant shared is the “Coinbase Premium Gap”, which tracks the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

As the chart below shows, the 30-hour moving average (MA) value of this metric has recently fallen into the red.

A negative value on Coinbase Premium Gap indicates that the asset is trading at a lower price on Coinbase compared to Binance. The first stock exchange is the favorite platform of American investors, especially large institutional entities, while the second represents the host of global traffic. As such, the red premium may be a sign that US-based whales are selling more than global investors.

“Coinbase Premium Gap fell to -$90, a sign of strong selling pressure in the US,” the analyst firm explained. Another metric that indicates extreme selling pressure from US traders during the recent price decline is the cumulative return for different trading sessions.

From the chart above, it is evident that both European and Asia Pacific trading hours saw a near neutral return for Bitcoin over the past month. The American session, on the other hand, witnessed deep negative value.

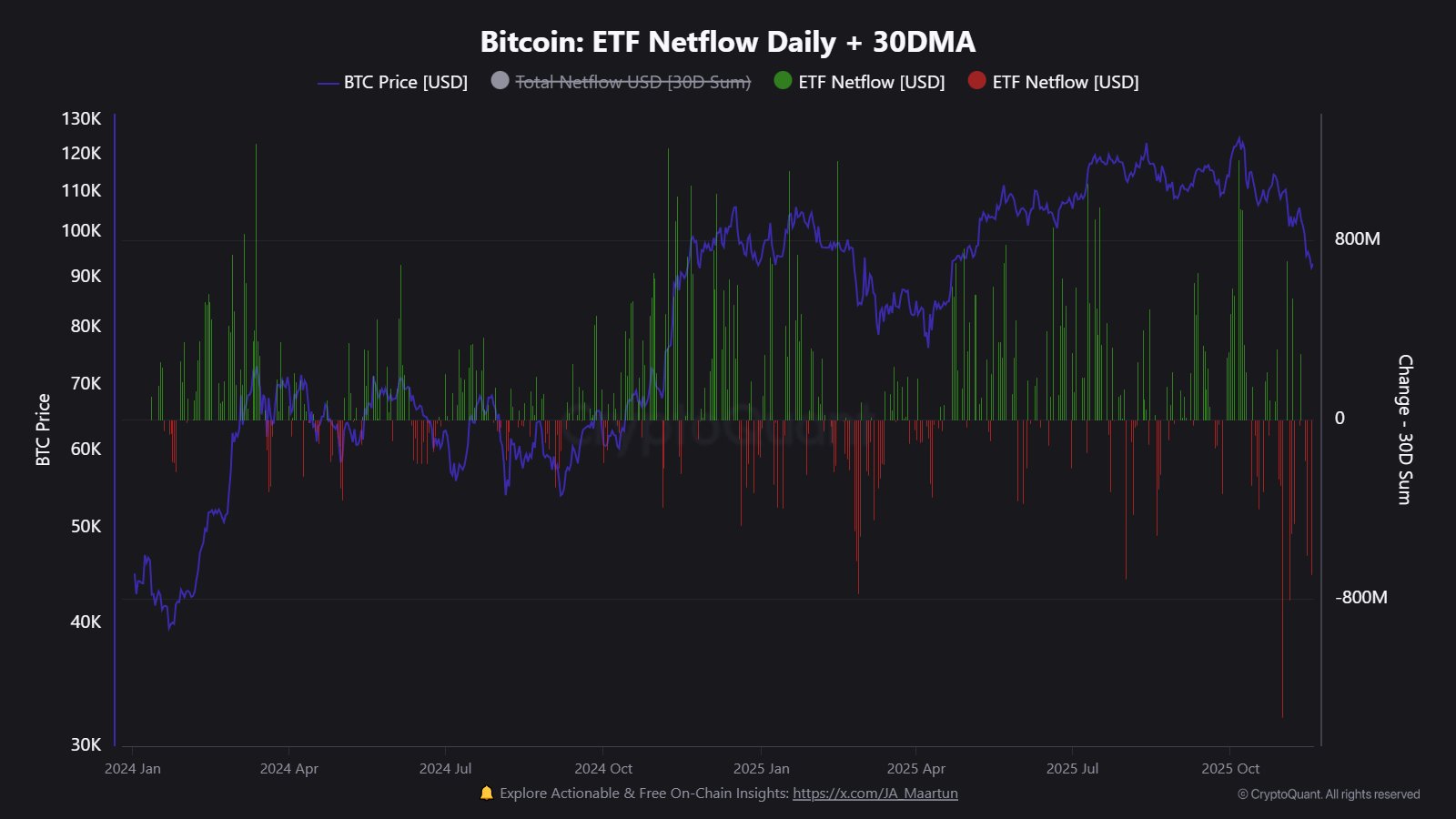

Another important way that institutional entities invest in Bitcoin is through exchange-traded funds (ETFs), investment vehicles that hold BTC on behalf of their investors and allow them off-chain exposure to the coin’s price movements.

These funds have also witnessed outflows during the sell-off in the past few weeks.

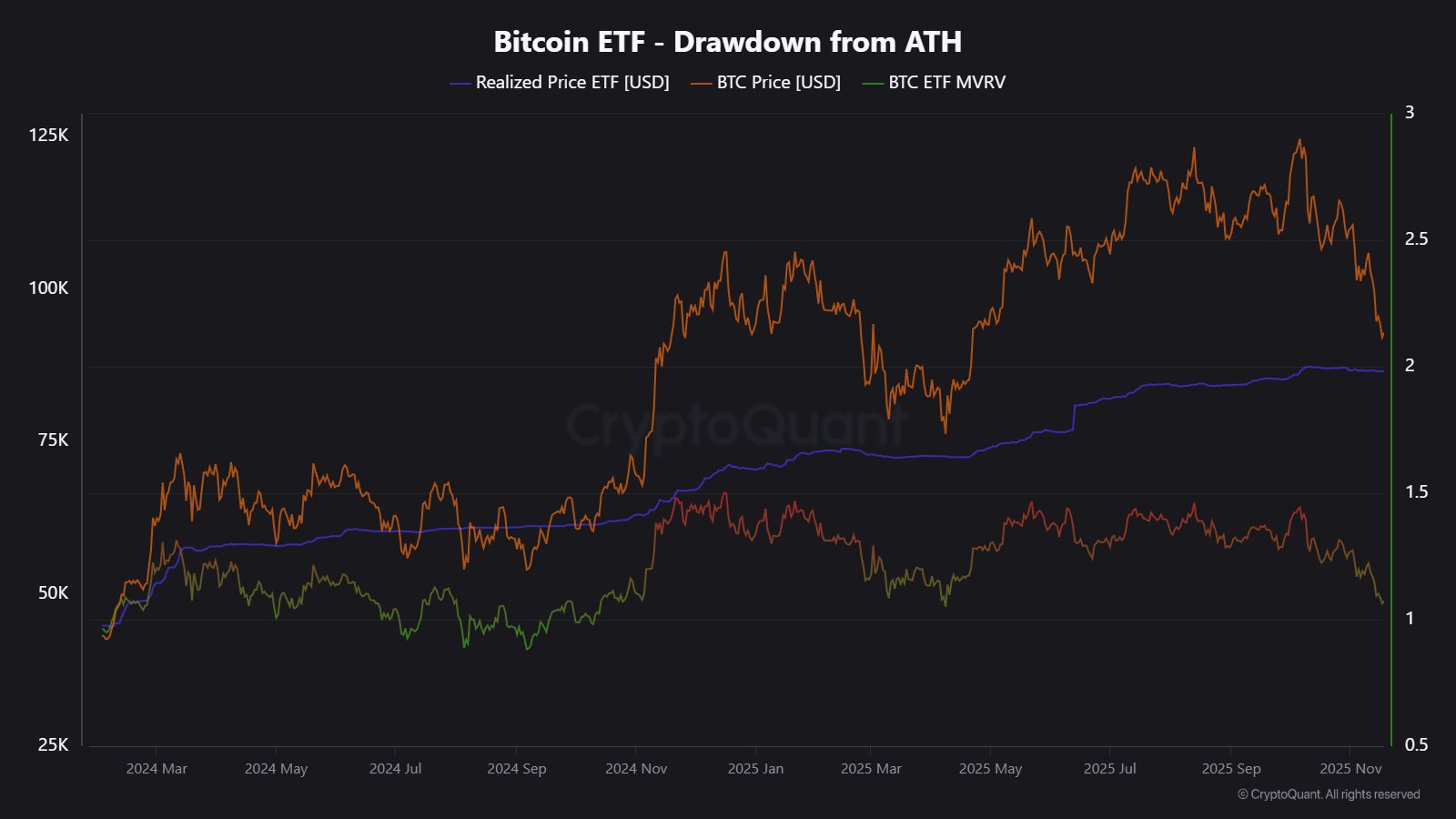

ETFs have seen net outflows for three consecutive weeks, a departure from last year’s trend in the fourth quarter, where 194,000 BTC flowed into wallets linked to those funds, but so far in Q4 2025, 8,000 BTC have flown out instead. “ETF outflows continue to weigh on BTC spot market,” noted CryptoQuant.

As for what could be next for Bitcoin, it’s worth paying attention to the cost basis of spot ETFs, which sits at $86,566. If the cryptocurrency falls below this mark, spot ETF holdings will sink.

The price of BTC

At the time of writing, Bitcoin is hovering around $92,000, down more than 10% in the past seven days.