Bitcoin slipped below the $92,000 mark on Wednesday, trading at $91,500 at press time after a 5% one-day decline that sent the token down 17% over the past 30 days.

Related reading

Market players were shaken after a series of severe swings that began with a peak in early October. According to market researchers, pressure on prices has pushed sentiment into deep fear as investors reassess risk.

Winklevoss sees an opportunity

According to posts on X by Cameron Winklevoss, prices below $90,000 may not last long. “This is it the last time you will ever be able to buy bitcoin under $90k!” he said.

Cameron and his brother Tyler have long compared Bitcoin to modern gold and suggested it could one day reach $1 million, a view that frames the current pullback as a buying window rather than a permanent setback. Some industry leaders echoed that sentiment, calling the downturn an opportunity to accumulate long-term customers.

This is the last time you will ever be able to buy bitcoin under $90k!

— Cameron Winklevoss (@cameron) November 18, 2025

The October shock is still reverberating

Bitcoin’s recent decline followed a new high of $126,200 on October 6, 2025, and heavy liquidations four days later that wiped out close to $20 billion in leveraged positions.

Analysts who track market cycles say this pullback fits the usual pattern following the April 2024 halving, with major highs often coming 400-600 days after that.

Reports from The Kobeissi Letter suggest that much of the current weakness looks like routine unwinding of margin positions rather than a collapse in underlying demand.

The whales are piling up

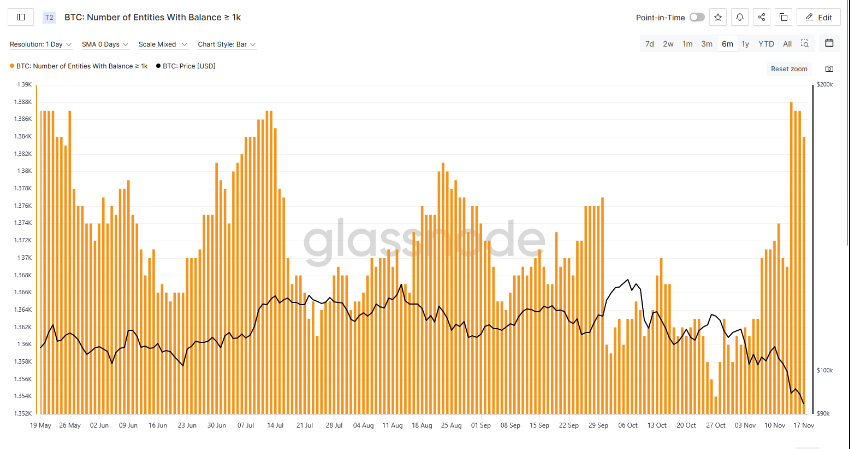

According to Glass nodewallets holding 1,000 BTC rose from 1,354 on October 27 to 1,384 on November 17, an increase of 2.5%. At the same time, smaller landowners moved away; addresses with less than one BTC fell from 980,577 to 977,420 in the same period.

Markus Thielen of 10X Research said large holders bought while absorbing selling pressure. Some of the buying activity has been quietly taking place and is being watched closely by analysts.

Related reading

Fear and market flows

Figures show that the Crypto Fear & Greed Index immersed to readings as low as 15, a level not seen since mid-2022.

CryptoQuant analyst JA Maartun labeled the reading extreme fear, while other industry voices pointed to ETF outflows and geopolitical tensions as additional stressors.

Bitwise CIO Matt Hougan described the current price as a “generational opportunity,” a term that comes alongside warnings of possible downside.

Featured image from Gemini, chart from TradingView