According to remarks made at a Yahoo Finance Invest event, Eric Trump told attendees he expects a major shift in the way money flows between traditional stores of value and newer digital assets.

Related reading

He said Bitcoin’s fixed supply of 21 million coins and growing institutional buying were key drivers. In a separate interview with Fox Business in late September, he predicted a long-term price target of $1 million per Bitcoin, a prediction that underscores just how optimistic his view is.

Bitcoin is considered a faster driver of value

Eric claimed that Bitcoin – which he called the “greatest asset” ever – transfers value faster and cheaper across borders than metal, which has to be hauled away and locked away.

He called Bitcoin “digital gold” and pushed the idea that its code-based offering gave it an advantage over physical bullion.

Based on the report, he also positioned cryptocurrencies as a hedge against inflation, corruption and loose monetary policy — reasons he said explain their growing adoption around the world.

JUST IN: 🇺🇸 Eric Trump says gold-to-bitcoin rotation is inevitable

“The ratio will shift disproportionately to Bitcoin.”

“It was the greatest fortune we had ever seen.” pic.twitter.com/4TYY1qALlm

— Bitcoin Archive (@BitcoinArchive) November 14, 2025

The rapid rise of US bitcoin

Eric and his brother Donald Trump Jr. they co-founded American Bitcoin (ABTC), which went public in September and now has a market value approaching $4 billion.

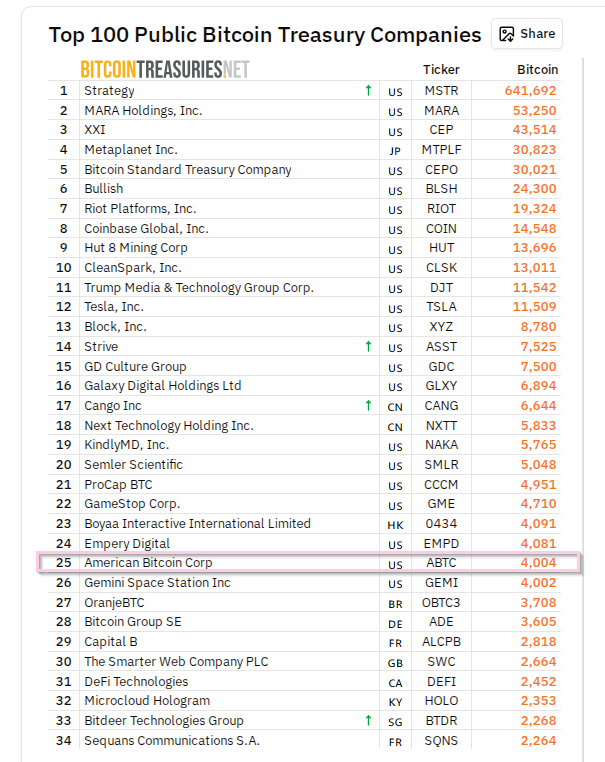

The company expanded rapidly after merging with Gryphon Digital Mining. According to Bitcoin Treasuries, ABTC is 25th largest public company holder of Bitcoin in the US.

Company officials say their mines in West Texas benefit from low energy costs, allowing them to produce Bitcoin at about half the current price.

Source: Bitcoin Treasuries

Company growth and risks

Growth has been rapid, but analysts and critics warn of clear risks. Mining companies gain when prices rise and can suffer when prices fall. Some worry that the combined ABTC-Gryphon deal faces more swings in earnings and asset values as crypto markets remain volatile.

There are also concerns about mixing political connections with finance; World Liberty Financialproject linked to the Trump family, operates the WLFI governance token and USD1 stablecoin, and some observers have flagged transparency questions.

A long record against a young network

Gold has been used as a store of value for centuries and is widely accepted globally. Bitcoin has been around since 2009 and exhibits rapid price swings that can create big winners and big losers.

Historical data points to sharp shifts: during the upswing in 2017, the ratio of Bitcoin to gold reached record highs before falling after a price correction. That history is often used to remind investors that gains can be followed by steep pullbacks.

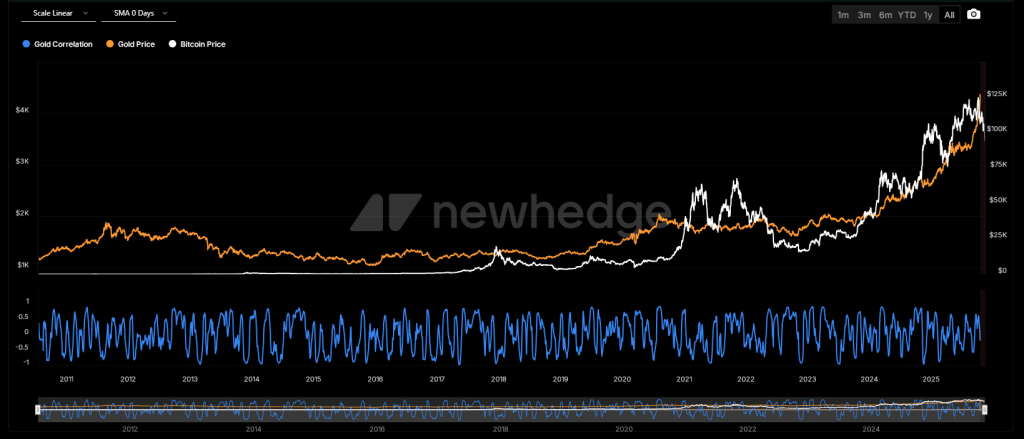

The correlation between the two has shifted over time, with each asset responding to different market pressures.

Bitcoin and gold correlation. Source: Newhedge.

What analysts and critics warn about

Conflict of interest is one common criticism: executives who publicly praise Bitcoin may also directly benefit when their companies hold or mine more coins.

Forecasts according to which one Bitcoin is worth a million dollars are considered by many to be speculative rather than certain. Regulatory changes, tax rules and political moves in the US or abroad could quickly change market conditions, and cautious commentators highlight these possibilities.

Related reading

Eric Trump’s position is clear: he believes capital will shift from gold to Bitcoin over time. The markets will decide whether that prediction turns out to be true. For now, both assets remain part of the conversation, each with different risks, costs and histories that investors must weigh.

Featured image from Alamy, chart from TradingView