According to the NYDIG researchBitcoin price movements are driven more by the strength of the US dollar and broad liquidity conditions than by direct links to inflation.

Greg Cipolaro, NYDIG’s global head of research, said the data show weak and inconsistent links between the two inflation measures and Bitcoin. That view diverts attention from the old story that Bitcoin is mostly a hedge against inflation.

Related reading

Link to inflation Weak

Cipolaro argued that inflation expectations are a slightly better signal than overall inflation readings, but are still not an accurate indicator of Bitcoin price.

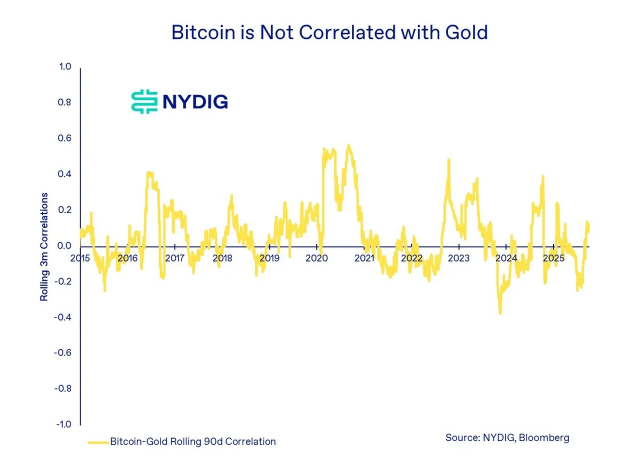

Instead, both Bitcoin and gold tend to gain when the US dollar weakens. While the inverse relationship between gold and the dollar has long been established, Bitcoin’s inverse movement against the dollar is more recent but visible.

Gold and Bitcoin react to the movement of the dollar

Based on the report, gold has historically risen as the dollar falls. Bitcoin follows that pattern, although its correlation is less stable than gold.

As Bitcoin becomes more connected to mainstream finance, NYDIG expects its inverse relationship with the dollar to likely strengthen.

This makes sense to traders who value everything in dollars and look for alternatives when the dollar loses purchasing power.

Interest rates and money supply

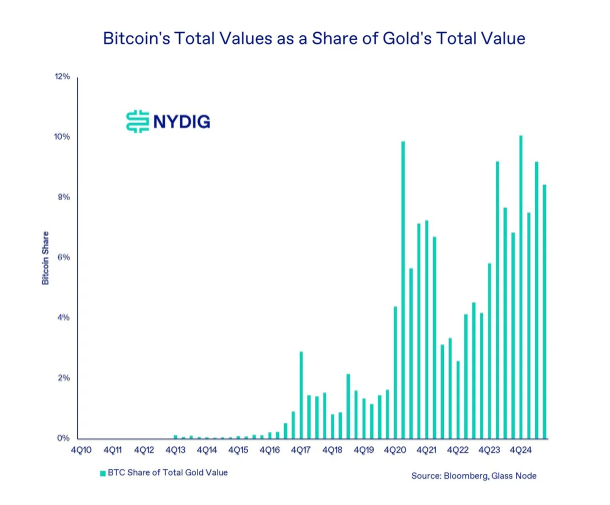

Cipolaro highlighted interest rates and the money supply as the two main macro levers driving both gold and Bitcoin.

Lower interest rates and looser monetary policy mostly supported higher prices for these assets.

In simple terms, when borrowing costs fall and liquidity rises, Bitcoin often benefits. In the wallet, gold is framed more as a hedge against the real rate, while Bitcoin is described as a gauge of market liquidity – a subtle but important distinction for investors.

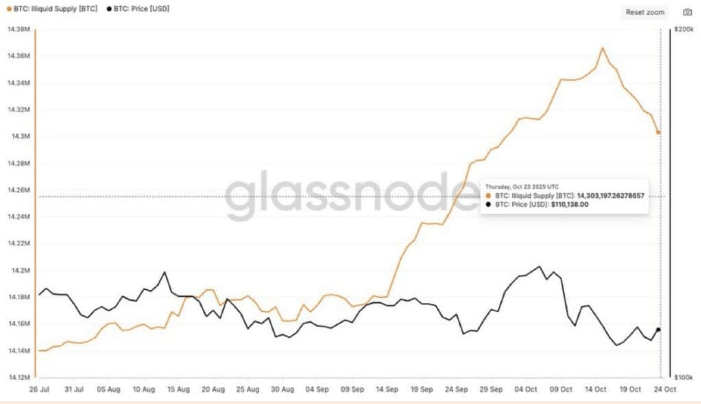

Illiquid supply decreases, selling pressure returns

Chain data shows signs of repeat sales. Reports say that illiquid Bitcoin — coins held in long-dormant wallets — fell from 14.38 million earlier in October to 14.300 million on October 23.

Related reading

That change means roughly 62,000 BTC, worth about $6.8 billion at recent prices, has been put back into circulation. In the past, large inflows have put pressure on prices. In January 2024, a significant amount of coins became available which caused the price momentum to moderate.

According to Glassnode, there has been a consistent sell-off of wallets holding between 0.1 and 100 BTC, with supply for first-time buyers shrinking to ~213,000 BTC.

The overall assessment from a macro perspective and metrics on the chain is not favorable. Demand from new buyers seems to be less, momentum traders seem to have backed off, and more coins are now available to trade. This combination can halt rallies or deepen pullbacks until liquidity conditions improve or the dollar weakens.

Featured image from Gemini, chart from TradingView