A cohort of long-term Bitcoin holders appears to have stopped net selling, according to multiple on-chain commentators, in a move that could remove a key source of structural supply pressure heading into 2026.

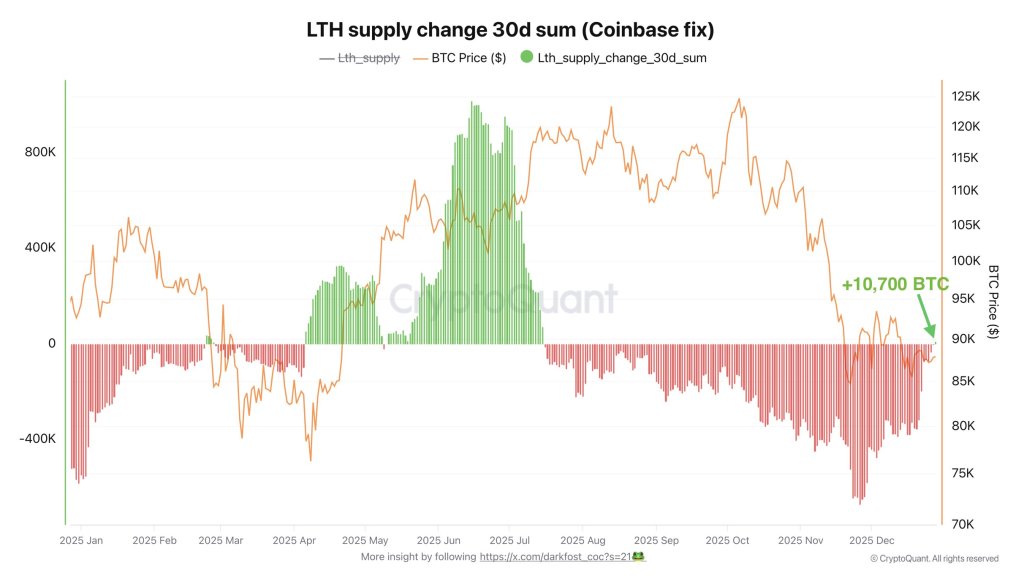

The change depends on a reading of the change in the supply of long-term holders (coins held for more than six months), which has been negative for months but has now turned modestly positive, chain analyst Darkfost said.

Is this a bitcoin bottom signal?

Darkhost claims that recent claims of long-term holders “selling more than ever” miss what the data actually shows, especially when large, discrete exchange-related movements distort the picture. “On this chart, which I adjusted to isolate the movement of nearly 800,000 BTC from Coinbase that was skewing the LTH data, we can see a clear shift in supply change,” Darkfost wrote. “As of July 16, the monthly LTH supply change (30-day sum) was firmly anchored in the distribution phase until recently.”

Related reading

In simple terms, this meant that the proportion of supply held by long-term holders declined for much of the second half of 2025, a regime that usually coincides with persistent selling pressure as older coins turn around in the market. That phase, Darkfost said, was now over, at least for the moment.

“We’re now back in positive territory, with about 10,700 BTC moving into long-term coins,” Darkfost wrote, calling it a “very modest change” but “not insignificant.” The implication is that long-term holders have reduced the distribution enough that their total holdings start to rise again, even if short-term holders “still hold their BTC”, according to Darkfost.

CryptoQuant CEO Ki Young Ju reiterated the guidance in a shorter post, saying, “Long-term holders of bitcoin have stopped selling.”

Related reading

VanEck’s Head of Digital Research Matthew Sigel characterized pivot as a significant change in positioning pressure via Xa. “BTC: Long-term holders turn net accumulators, easing Bitcoin’s major resistance and ending, for now, the biggest selling pressure event from this group since 2019,” Sigel wrote.

Noted expert James Van Straten added historical context to the scale of the move, saying the size of the distribution “also marked the bottom of 2019,” suggesting that the current inflection is significant even if it doesn’t in itself warrant a repeat.

Darkfost also pointed to a historical pattern around these reversals. “Historically, such moves have often preceded the formation of consolidation phases or even strong recoveries, depending on how the broader trend unfolds,” he wrote, emphasizing conditions rather than certainty.

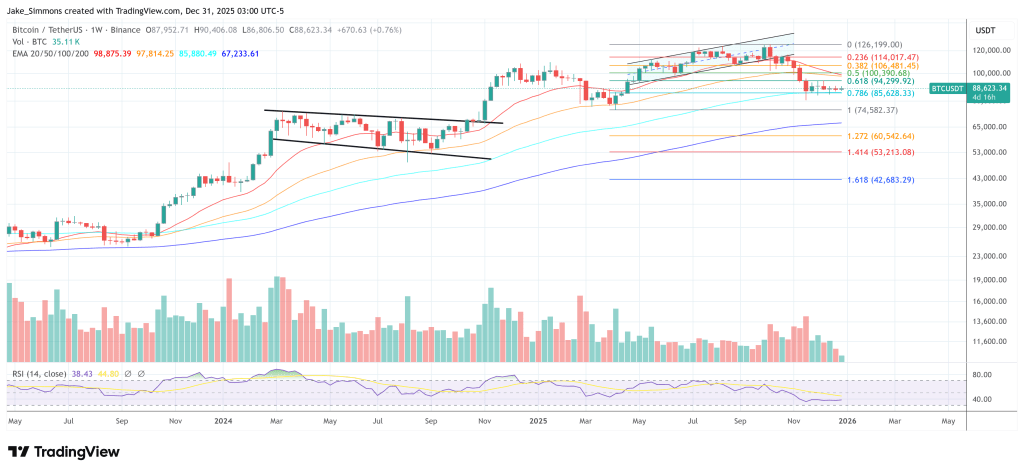

At press time, BTC was trading at $88,623.

Featured image created with DALL.E, chart from TradingView.com