EMJ Capital CEO Eric Jackson laid out one of the most aggressive long-term bitcoin goals in the space yet, claiming in an interview with journalist Phil Rosen that the cryptocurrency could reach $50 million per coin by 2041. His projection is tied to the thesis that bitcoin will evolve from “digital gold” into the core collateral layer of the global financial system.

Jackson said his thinking stems from the same “hundred-bag” framework he used when buying failed stocks like Carvana. He recalled getting into Carvana after its share price had fallen from about $400 to about $3.50 in 2022, at a time when sentiment was almost universally hostile. “You’d hear things like it’s run by a bunch of criminals. This is a bunch of idiots. Like you’d have to be an idiot to let your company go from $400 this year to $450 or rather $350,” he told Rosen.

Related reading

For Jackson, that period illustrated how markets behave in extremes. “It’s almost human nature that when you’re in a moment of maximum pain or pessimism, you can only see what’s right in front of you,” he said. Still, the core product remained strong: “It wasn’t a broken platform. It wasn’t a broken service (…) they would tell you they loved it. It was so simple. It was the best user experience they had.” From there, he could “predict how they will be a much more profitable business” once the company focuses on profitability and resolves its debt problem.

Jackson’s Long Term Bitcoin Thesis

He applies the same long-horizon lens to bitcoin, arguing that the everyday label and polarized narratives obscure its structural potential. “We’re so attached to turning on the TV and just looking at, like, what’s the price of Bitcoin today (…) Some people are bearish and say, oh, it’s a Ponzi scheme. And some people are bullish and they just, you know, throw these pie-in-the-sky targets that you can’t really relate to reality,” Jackson said. “It’s a bit hard to get hold of like, what’s the value of this thing?”

Jackson starts with the usual “digital gold” framing. He asks how big the gold market is, how many central banks and countries hold it and why. “Could Bitcoin one day be as big as gold? That seems like a safe bet,” he argued, adding that younger generations would prefer it as a store of value, as it is “digital” and “programmable” rather than a “compact rock.” But he stresses that’s only part of the story, since bitcoin hasn’t become a medium for daily transactions “since the guy who bought a pizza with Bitcoin in 2011.”

“The penny dropped,” he said, as he began to think in terms of what he calls the “global collateral layer” that backs sovereign and central bank borrowing. Historically, that base layer shifted from gold to the Eurodollar system from the 1960s onwards, and today is heavily intertwined with government debt. “All countries around the world issue debt and then sort of borrow on top of it and go about their daily like government transactions,” he noted, but “there are problems with that.”

Related reading

In Jackson’s “Vision 2041,” bitcoin replaces the Eurodollar and, functionally, becomes a neutral asset upon which other balance sheets are built. He argues that bitcoin is “much superior” as collateral because it is digital and “apolitical”, outside of central banks and influenced by “whoever is the latest US Treasury Secretary”.

As with the eurodollar, he sees this not as a direct attack on the dollar or the treasury, but as a new underlying layer: “There’s some underlying thing that a lot of other countries and financial systems are borrowing against to get things done in some way.”

Eric Jackson (@ericjackson) expects bitcoin to reach $50 million by 2041.

He compares his thesis with the way he knew Carvana, $CVNAwould be a 100 bag stock selection. pic.twitter.com/CA9BWoR4zF

— Phil Rosen (@philrosenn) December 7, 2025

Looking ahead 15 years, Jackson envisions states issuing and repaying debt instantly instead of “relying on Bitcoin,” because “it makes a lot more sense over time.” Given the “enormous” scale of the world’s sovereign debt, he argues that if bitcoin becomes the dominant collateral substrate, its price per coin will have to reach orders of magnitude above current levels – hence his $50 million target by 2041.

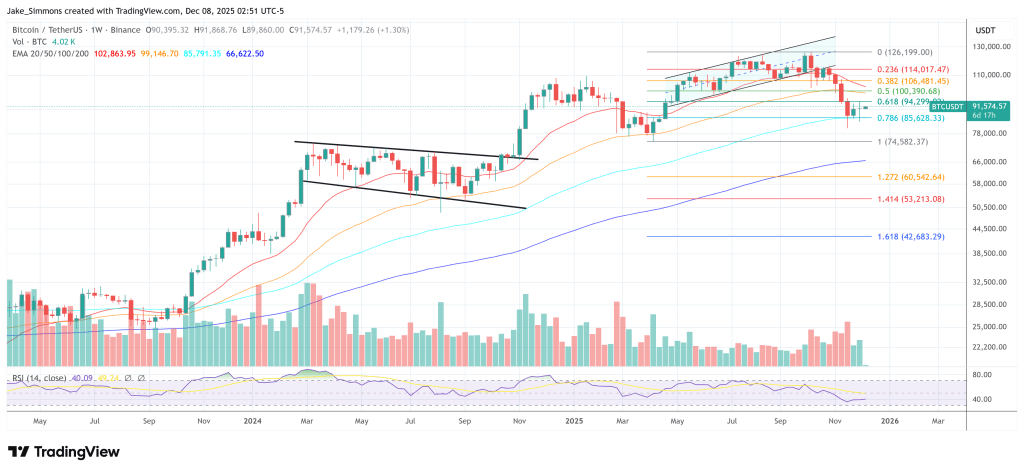

At press time, Bitcoin was trading at $91,574.

Featured image created with DALL.E, chart from TradingView.com