Major Dogecoin holders have sharply reduced their activity on the chain, with whale transactions falling to their lowest level in more than two months, according to fresh network data shared by chain analyst Ali Martinez.

Posting the Santiment map on X, Martinez stated that “whale activity on the Dogecoin network has fallen to its lowest level in two months.” The graph tracks the price of DOGE in relation to the number of transactions greater than one million dollars. It shows frequent, high spikes in high-value transfers in early October 2025, when the price oscillated near the ceiling near $0.27.

Dogecoin Whales plummet

On the day of the crash on October 10, the biggest peak occurred when more than 280 Dogecoin whales transacted. This was followed by a progressive decline until the end of October and November. By November 29, the whale transaction bar has dropped to 3 even as the price hovers around $0.15.

The decline has fueled debate about what it signals for market structure and liquidity. Responding to Martinez, analyst account CryptoGames3D asserted that “declining whale activity on Dogecoin could mean one of two things: either the whales are holding tight and waiting, or they are exiting the game; both cases carry risk. With low liquidity for large holders, even modest selling could hit prices hard.” The commentary highlights concerns that less participation by large entities could make order books more fragile if conditions change.

Related reading

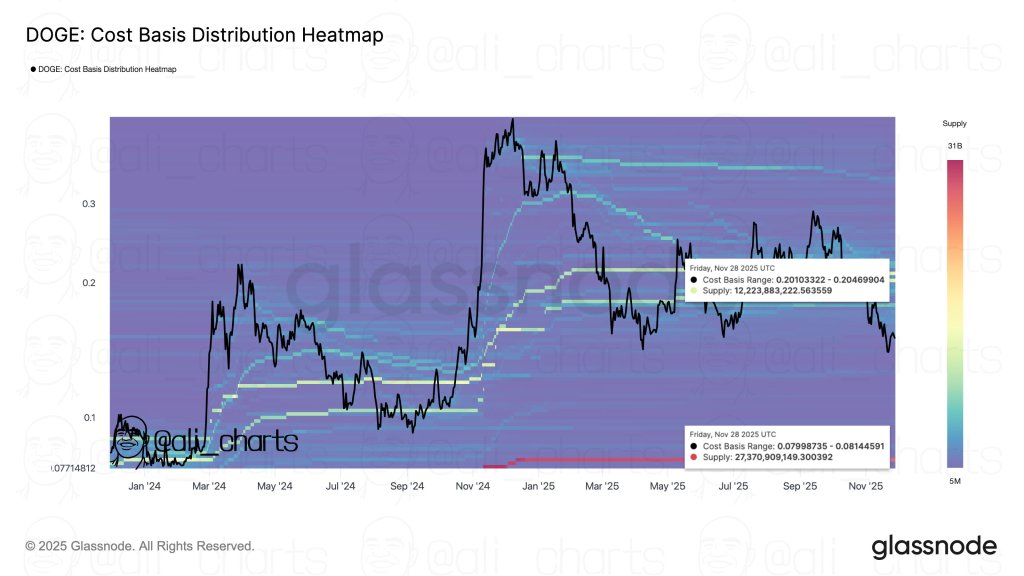

In a separate post on November 29, Martinez described what he called “key levels for Dogecoin DOGE,” citing “support at $0.08” and “resistance at $0.20.” These levels are reflected in the Glassnode cost-based distribution heatmap he shared, which maps the price of DOGE since early 2024 against realized price ranges where supply last moved.

Related reading

The heatmap reveals a dense cluster of bids around $0.08. The highlighted range between approximately $0.07999 and $0.08145 contains approximately 27.37 billion DOGE, marking it as the support zone of the main realized price. Above, a second but thinner band between approximately $0.20103 and $0.20470 holds around 12.22 billion DOGE, forming a significant cohort of resistance. The color scale, which ranges from about 5 million to 31 billion DOGA, highlights how low the cluster is expressed in relation to other price areas.

Taken together, the datasets present a narrowly framed picture. DOGE is currently trading between a heavy long-term owner cost base near $0.08 and a pocket of resistance around $0.20, while the number of transfers of more than $1 million has been reduced to a multi-month low.

At press time, DOGE was trading at $0.137.

Featured image created with DALL.E, chart from TradingView.com