On-chain data shows that New Whales on the Bitcoin network have recently made losses, while Old Whales have remained on the sidelines.

Bitcoin Faced Losing Sales From Newbie Whales

In the new one publish at X, CryptoQuant community analyst Maartunn talked about the latest trend in Bitcoin whales’ profit/loss realization behavior. “Whales” generally refer to BTC investors who hold at least 1000 tokens in their balance.

At the current exchange rate, the cap for the cohort is equivalent to $91.6 million, which is quite significant. As such, this group represents the big money hands in the market, which can have some degree of influence.

Whales can be divided into two subgroups based on their retention time. Investors of this size who bought their coins in the last 155 days are known as Short Term Holders (STH) or New Whales. Similarly, whales with longer retention times are called long-term keepers (LTH) or old whales.

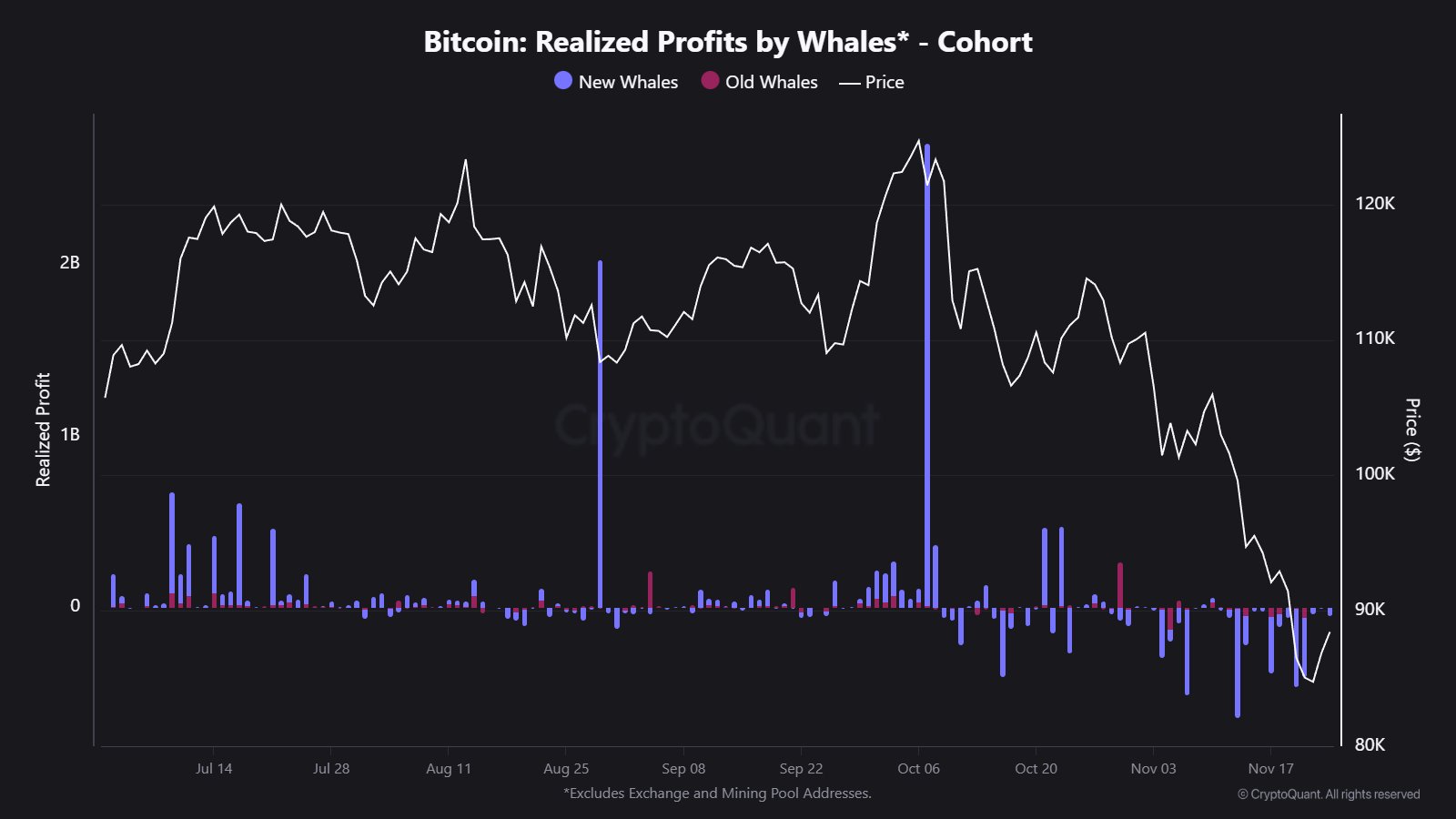

Now, here’s a chart shared by Maartunn that shows the trend in the net profit/loss amount these Bitcoin whale groups have made from their sales over the past few months:

As shown in the chart above, Bitcoin New Whales has recently shown some spikes in loss realization. This underwater selling from the cohort occurred as the price of the cryptocurrency fell.

New whales include inexperienced hands in the market who easily panic in the face of volatility. This quality of the group seems to have been maintained during the last fall.

On the other hand, the Old Whales are considered to represent the decisive side of the network. It is evident from the chart that these large dormant entities have recently seen some short selling, but the scale was small compared to the capitulation of New Whale.

The fact that the presence of old whales is relatively muted due to the bearish move, as well as the subsequent pullback, could be a signal worth paying attention to.

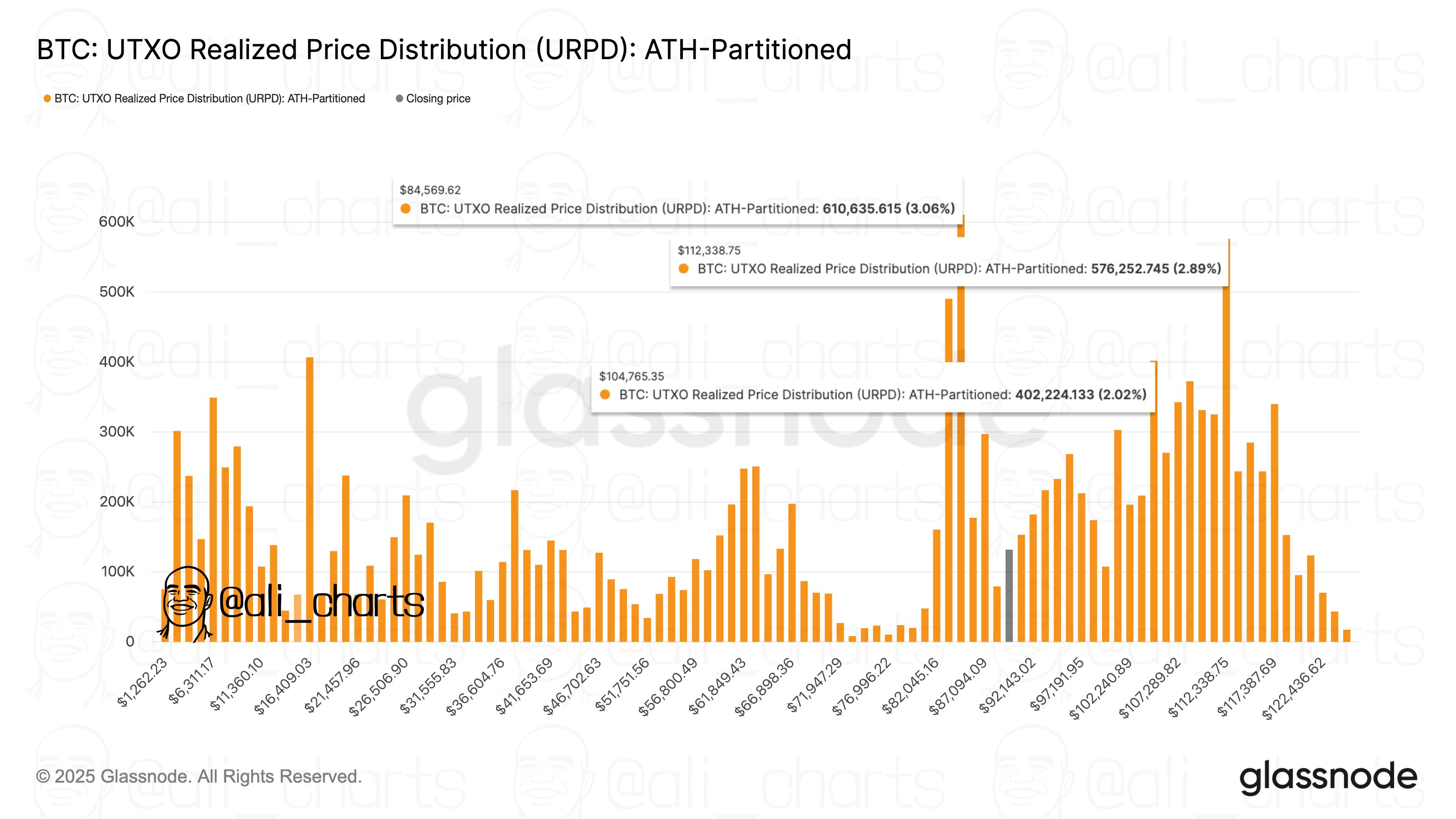

Speaking of recovery, the rise of Bitcoin has meant that its price has climbed back above the main cost level on the chain. As analyst Ali Martinez shared in X publishThe realized price distribution of Bitcoin UTXO (URPD) suggests that a large buy last occurred at $84,500.

In on-chain analysis, zones of strong demand below the spot price are considered potential support points for Bitcoin. Similarly, upper levels are assumed to be sources of resistance instead. One such major level is present at $112,300.

The price of BTC

Bitcoin’s recovery extended over the past day as its price returned to $92,300.