Top stories of the week

Ripple rejects IPO plans despite SEC win: Here’s why

Ripple, the US blockchain company behind the cryptocurrency XRP, will not proceed with an initial public offering after ending a years-long legal battle with the US Securities and Exchange Commission.

Ripple president Monica Long said the company has no plans or timelines for an IPO, according to a Bloomberg report on Wednesday.

“We’re in a fortunate position where we’ve been able to be very well capitalized and fund all of our organic growth, inorganic growth, strategic partnerships, everything we want to do,” Long said.

Ripple’s decision to forgo an IPO ended years of speculation, after multiple executives hinted at one. The company was hit by a $1.3 billion SEC lawsuit at the end of 2020.

Bitcoin bull run hasn’t started yet: Jan3’s Samson Mow

Samson Mow, CEO and founder of Bitcoin technology infrastructure company Jan3, claims that Bitcoin’s rally has yet to begin, as Bitcoin fell to just below $100,000 earlier this week.

“Bitcoin’s bull run hasn’t started yet. We’re only marginally outperforming inflation in this price range,” he said on Wednesday.

Bitcoin and the broader cryptocurrency market continued to fall this week, with analysts attributing the drop to trade tensions between the US and China, as well as other macroeconomic factors. Bitcoin sales intensified on Tuesday, with data from CoinGeck showing the price fell to $99,607 on Wednesday.

However, in a series of encouraging X announcements, Mow predicted that the market still has plenty of upside on the horizon as Bitcoin continues to outpace the US inflation rate of 3%.

FBI can’t be blamed for wiping hard drive with $345 million in BTC, judges say

A man convicted of identity theft who claims the FBI seized and wiped his hard drive containing more than 3,400 Bitcoins has lost his case against the government in a US appeals court.

A three-judge panel in the Eleventh Circuit Court of Appeals found on Tuesday that Michael Prime cannot sue the government for losing the key to access some 3,443 Bitcoins, now worth $345 million, because he previously claimed he did not own that amount of cryptocurrency.

Prime asked a court after his release from prison in July 2022 to return the hard drive containing the Bitcoin, but the FBI wiped it as part of standard procedure, which Prime claimed was illegal; said the judges.

“For years, Prime denied that he even had many bitcoins. And bitcoin was not on the list when he sought the return of missing property after his release from prison,” the judges wrote. “Only later did Prime claim to be a bitcoin tycoon.”

The truth behind the return of the privacy-focused Zcash protocol in 2025

Privacy is all the rage, and there’s a big winner in the market. The Zcash protocol is the talk of the crypto community on X, and the price of its native token, Zcash, reflects that talk.

Zcash’s token is trading above $500 for the first time since 2018, fueled by an intriguing trend of support from some of the industry’s most popular commentators.

People like Arthur Hayes, Naval Ravikant, Mert Mumtaz, Ansem, Threadguy and other famous accounts have been touting the privacy-first benefits of Zcash for months. Lofty price predictions interspersed with touts of privacy played a role in ZEC’s massive returns compared to the broader altcoin landscape.

Columbia University researchers reveal that Polymarket is full of ‘artificial trading’

According to research published by Columbia University, the rapid growth of prediction market Polymarket may not be entirely organic, but instead inflated by artificial trading activity.

In an 80-page paper titled “Detecting Flushed Online Trading,” which has not yet undergone peer review, Columbia researchers identified extensive flushed trading activity on Polymarket beginning in July 2024. That month, they found that flushed trades accounted for nearly 60% of the platform’s total trading volume.

“This activity persisted through the end of April 2025 before weakening significantly and picking up again to about 20 percent of volume in early October 2025,” they wrote.

Researchers have determined that 25% of Polymarket’s total trading volume over the past three years can be attributed to artificial trading.

Winners and losers

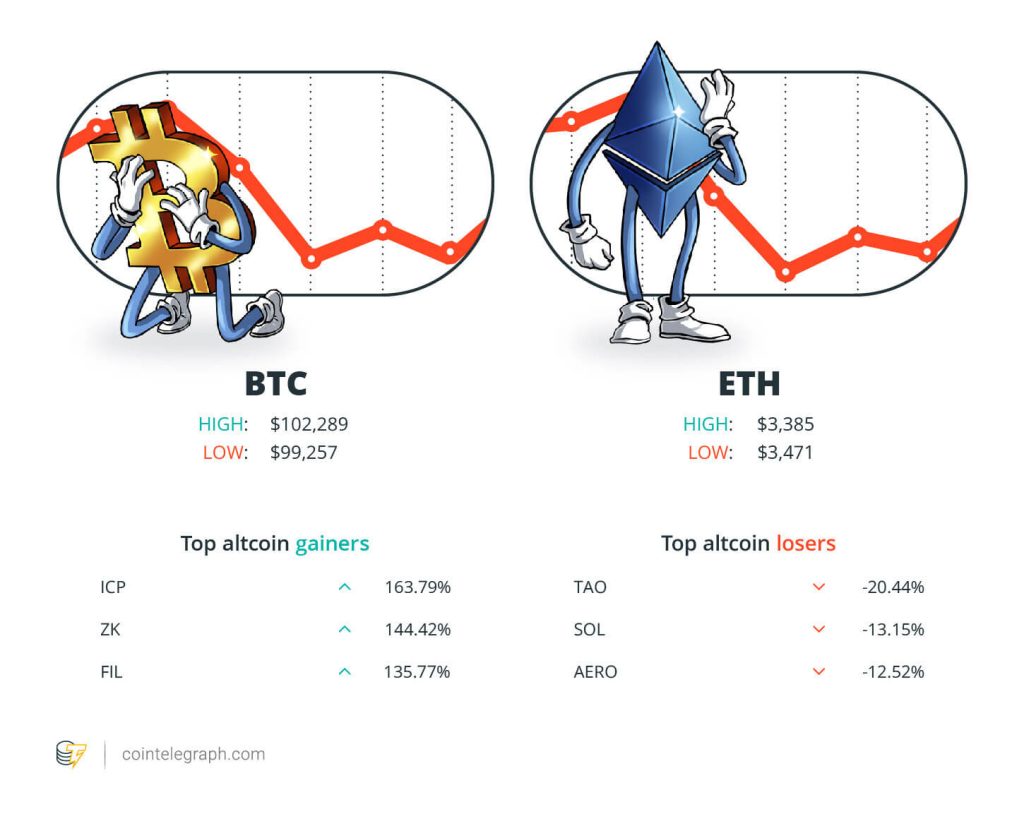

At the end of the week, Bitcoin (BTC) is 102,289 USD, Ether (ETH) to $3385 and XRP $2.30 each. The total market capitalization is 3.44 trillion dollars, according to on CoinMarketCap.

Among the top 100 cryptocurrencies, the top three altcoin gainers of the week are Internet Computer (ICP) and 163.79%, ZKsync (ZK) at 144.42% and Filecoin (FIL) to 135.77%.

The three biggest altcoin losers of the week are Bittensor (TAO) at 20.44%, Solana (SALT) at 13.15% and Aerodrom Finance (AERO) to 12.52 percent. For more information on cryptocurrency prices, be sure to read Cointelegraph’s market analysis.

The most memorable quotes

“Given what’s happening with the stablecoins, which are serving emerging markets the way we thought Bitcoin could, I think we could take maybe $300,000 from that big case, just for the stablecoins.”

Cathie WoodPresident of the Management Board of ARK Investment Management

“Bitcoin’s bull run hasn’t started yet. We’re just slightly outpacing inflation in this price range.”

Samson Mowexecutive director Jan3

“We like the alignment with the community. We’re a big player in cryptocurrency. We want to continue to do that. We like that our customers are involved in it.”

Shiv Vermasenior vice president, finance and strategy, and treasurer at Robinhood

“Distributed ledger technology that facilitates the tokenization of assets could fundamentally transform our capital markets, in the same way that the introduction of CHESS once did.”

Joe Longochairman of the Australian Securities and Investments Commission

“Still a great area to accumulate ETH positions.”

Michael van de Poppefounder of MN Trading Capital

“Crypto retail is in utter despair.”

Matt Houganchief investment officer at Bitwise

Best prediction of the week

Bitcoin crosses $100k as BTC’s ‘bottom price phase’ begins

Bitcoin threatened support at $100,000 again on Friday as bulls hoped for a higher low. Data from Cointelegraph Markets Pro and TradingView showed that BTC price retreated to near $99,000 around the Wall Street open.

After failing to provide significant relief from multi-month lows, BTC/USD continued to pressure bulls and late long positions.

Data from tracking resource CoinGlass puts 24-hour crypto liquidations at over $700 million at the time of writing.

Best FUD of the week

Bitcoin at $100,000 ‘accelerated’ to $56,000, but data shows no signs of panic

The price of Bitcoin could fall by almost 50% if its current downtrend over the past month continues, according to a traditional financial analyst.

Read also

Features

Safe harbor or Voatz thrown to the sharks?

Features

Arthur Hayes doesn’t care when his Bitcoin predictions are completely wrong

However, onchain analytics firm Glassnode suggests that Bitcoin’s current downward trend may not be as severe as some market participants believe.

Bloomberg analyst Mike McGlone said in an X post on Thursday that Bitcoin reaching $100,000 could be a “slow step toward $56,000.”

“My look at the chart shows how normal it is for the first-born cryptocurrency to return to its 48-month moving average, which is now around $56,000, after a similarly extended rally like 2025,” McGlone added.

Australia risks ‘missed opportunity’ by avoiding tokenization: chief regulator

Australia’s capital market risks being outperformed by other countries unless it embraces new technology such as tokenisation, the country’s top markets regulator says.

Read also

Features

Are CBDCs Kryptonite for Crypto?

Features

What it’s like when banks fail: Iceland in 2008 firsthand

“As other countries adapt and innovate, there is a real risk that Australia could become a ‘land of missed opportunities’ or be a passive recipient of overseas developments,” Australian Securities and Investments Commission chairman Joe Longo told the National Press Club on Wednesday.

“The choice is to innovate or stagnate – evolve or die out.”

Cathie Wood Lowers BTC Forecast by $300k, Says Stablecoins Are Declining Market Share

ARK Investment Management CEO Cathie Wood has cut her long-term Bitcoin price projection by $300,000, warning that stablecoins are eroding Bitcoin’s role as a store of value in emerging markets.

“Stablecoins are usurping part of the role that we thought Bitcoin would play,” Wood, who previously forecast BTC’s peak price of $1.5 million by 2030, told CNBC on Thursday.

“Given what’s happening with the stablecoins, which are serving emerging markets the way we thought Bitcoin could, I think we could take maybe $300,000 off that growth, just for the stablecoins. The stablecoins are growing here, I think, much faster than anyone would expect,” she said.

The most popular magazine stories of the week

Grokipedia: ‘Far-Right Talking Points’ or a Much-Needed Antidote to Wikipedia?

Elon Musk’s experiment to reshape Internet truth, Grokipedia, is advertised as a more neutral and comprehensive rival to Wikipedia, but is it?

Philippine Anti-Corruption Blockchain Account Charged Crypto KOLs: Asia Express

Impacts include JPEX charged by Hong Kong police, Philippine anti-corruption blockchain bill set for Senate session, and more.

Why artificial intelligence is getting in the way of freelance jobs and real-life tasks: AI Eye

AI can’t complete 97% of Upwork tasks and gets the wrong news half the time. Your job is safe for now.

Subscribe

The most compelling reads in blockchain. Delivery once a week.

Editorial office

Cointelegraph magazine writers and reporters contributed to this article.