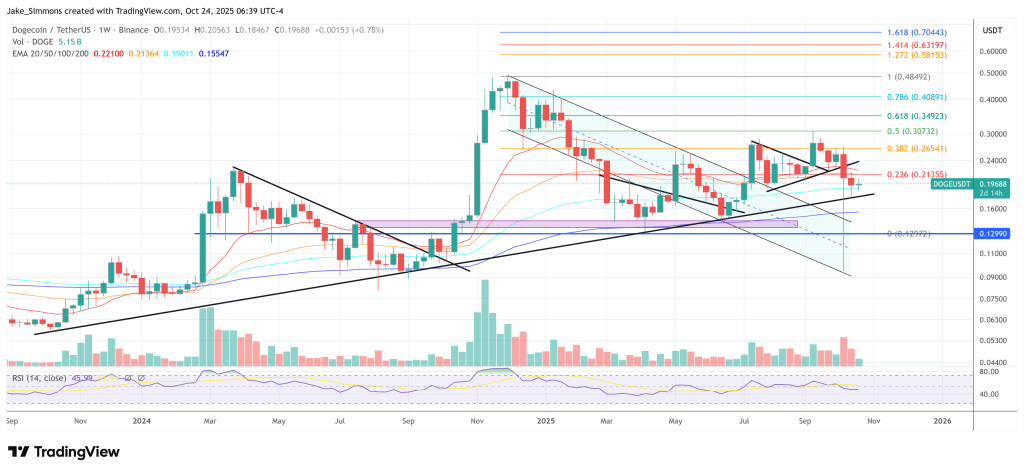

Dogecoin is on the edge defined by a narrow 4-hour range and a larger weekly triangle — two structures that now provide the framework for the next expansion in volatility.

Two Dogecoin Price Levels Are Crucial Now (4H Chart)

On the intraday chart divided Daan Crypto Trades (@DaanCrypto), DOGE is trading near $0.19585 with a clearly marked “break level” at $0.21817 and “hold level” at $0.17789. Price is hovering around the middle zone of the range after the bounce after the washout, while the higher low cut last Friday remains a key defense that keeps the structure constructive.

As Daan said, “DOGE gives a good overview of the market. Since the big flush, we’ve had an initial spike. Not many coins are trading in that area, but instead a range has formed. Higher lows were made last Friday and prices are now right in the middle.”

Related reading

Daan’s trigger is unambiguous and explicitly crossed. “A break above that local top, which corresponds to $BTC ~116K$, would mark a new higher local high and likely the end of this consolidation for a while.”

In contrast, his risk line is just as stark: “Breaking below last Friday’s low and losing the range would not be good short-term, medium-term. Right now, most coins (including Bitcoin) are right in the middle.” Tactically, this anchors DOGE’s bull/bear resolution to a close through $0.21817 on the upside or a clean breach of the $0.17789 shelf on the downside, with Friday’s local higher low serving as market breakdown protection.

How could DOGE reach $3

Weekly Wyckoff Scheme from Hov (@HovWaves) situates the same battle within the macro triangle labeled (a)–(e), with the current sequence going through (c)–(e) before the ultimate thrust increases. Hov notes the nature of the bounce and the depth of the retracement that preceded it: “Well, we were right. DOGE corrected from the low and sold off by more than 50% (thread). As I mentioned in the last update, a macro triangle was the more likely outcome.”

A test of the downside “failed to reach our lower support level,” he adds, and “so far the move from the low is pretty fair,” before concluding: “We’ll have to watch how that plays out over the next week or so to see if our C wave is there.”

These levels are visible on the chart. The macro demand box spans roughly $0.06-$0.09, bracketing the deeper Fibonacci contingency at $0.5 ≈ $0.04206 and $0.618 ≈ $0.02142, while the descending triangle limit moves towards the $0.30 midpoint by 2025.

Related reading

The horizontal bid range around the $0.17 high to $0.21 low aligns exactly with Daan’s intraday gates — $0.17789 to hold and $0.21817 to break — highlighting why the current hold at ~$0.196 carries too much signal value. Hov’s terminal projection box is in the $2.20-$3.00 area, with a measured extension indicated at -0.236 ≈ $2.826, marking the heart of the upper target range if the triangle impulsively turns into wave (v).

The path to that upper frame requires sequential confirmation. First, DOGE needs a decisive break and hold above $0.21817 to print a local higher high and break out of the 4-hour range. Second, it needs to turn that renewed band into retesting support as it works through the overhead bid towards the weekly triangle’s descending trendline in the ~$0.30-$0.35 corridor.

Only a clean break of that macro lid – with the price action transitioning from corrective to impulsive – opens up a sustainable journey towards the $2.20-$3.00 target cluster. A failure to defend the micro base at $0.17789 would change the scenario, risking a return to the weekly demand zone at $0.090-$0.06 and, in an extreme bearish scenario, probing the deeper Fibonacci rail at ~$0.042 and ~$0.021.

At press time, DOGE was trading at $0.196.

Featured image created with DALL.E, chart from TradingView.com