Bitcoin is under heavy pressure again, sliding towards the $103,000 level as the broader crypto market undergoes a sharp decline. After days of volatility and failed recovery attempts, BTC lost key support, sparking fresh fears and accelerating the altcoin sell-off. Most major assets are showing heavy losses, and traders and investors are now wondering if the market has entered a deeper corrective phase.

Related reading

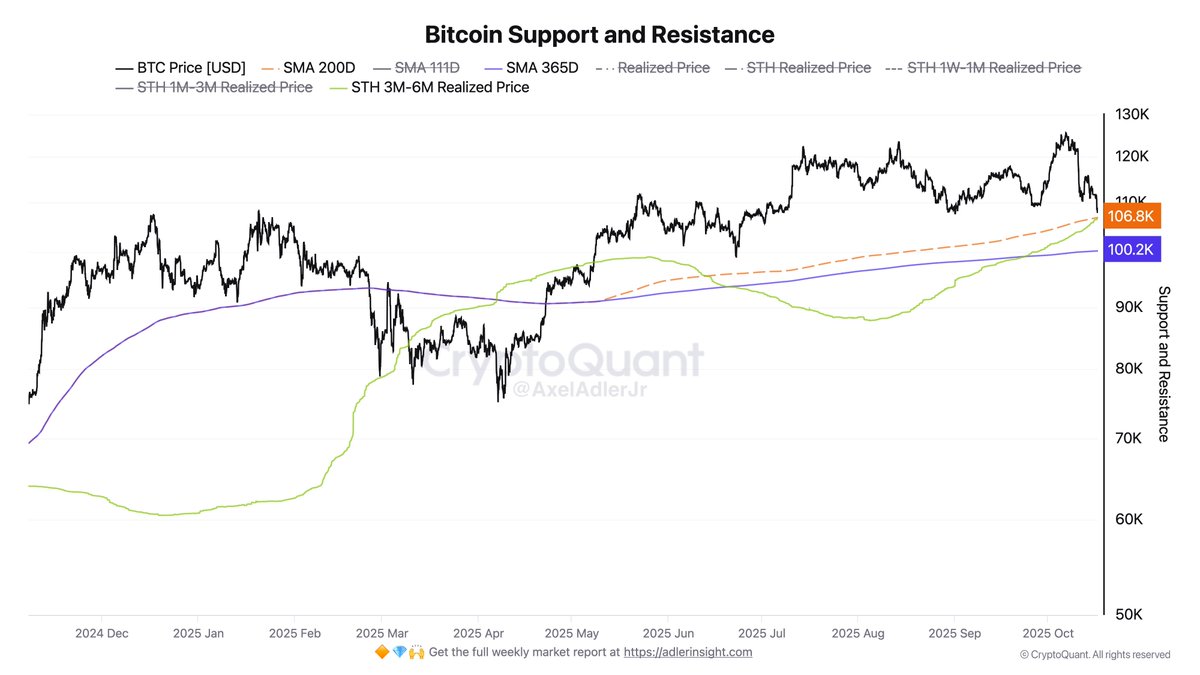

According to top analyst Axel Adler, Bitcoin’s main support zone lies between $106,000 and $107,000, a range defined by the 1M-3M Realized Price for Short-Term Holders (STH) and the 200-day Simple Moving Average (SMA 200D). This critical area represents the confluence of on-chain levels and technical support levels where previous corrections have historically found a balance.

However, current momentum is showing increasing weakness. As panic spreads and liquidity dries up, all eyes are now on the $106-107k range — a decisive battleground that could define Bitcoin’s near-term trajectory and set the tone for the rest of the crypto market.

Bitcoin’s market structure faces a crucial test

Adler emphasizes that a loss of the $106K level would likely trigger a move towards $100,000, where the annual moving average (SMA 365D) is currently aligned – a level that has historically acted as a springboard for major reversals during previous market cycles.

Despite the growing fear, Adler notes that the macro structure remains bullish as long as the $100K base exists. This region represents long-term interest for buyers, and its defense could reverse the overheated leverage and pave the way for a more stable recovery. However, Bitcoin is already trading below the $106,000 mark, raising concerns that the market may be preparing for a deeper test of this critical threshold.

Analysts around the world are now keeping a close eye on daily candle closes, which will determine whether the move below support is just liquidity momentum or confirmation of a continuation of the decline. If Bitcoin fails to recapture the $107k level soon, a broader shift in sentiment could develop – one that could extend the consolidation phase and test investor conviction.

In contrast, a strong bounce from the $100k zone would strengthen the argument that the correction is part of a healthy reset within the ongoing bull market. The coming days will therefore be decisive: either Bitcoin holds this base and rebuilds momentum, or it falls lower, signaling that the most aggressive phase of volatility in the current cycle is far from over.

Related reading

Bitcoin is testing a support zone amid continued weakness

Bitcoin continues to slide, with the latest chart showing the price hovering around $106,000, now testing one of the most critical support zones in recent months. After failing to recover the $115,000 and $117,500 resistance levels earlier this week, BTC extended its losses, touching an intraday low near $103,500 before recovering slightly. The market remains tense as traders watch to see if the 200-day moving average (SMA 200D) — currently around $107,500 — will hold.

This level represents the realized price area of the short-term carrier (STH) and coincides with the area that analysts have identified as a major structural base. A confirmed break below it could open the door to a test of $100,000, where the annual moving average (SMA 365D) aligns, serving as the next major support.

Related reading

Momentum indicators suggest that BTC is still under strong bearish pressure. The 50-day and 100-day moving averages are moving lower, indicating a loss of short-term momentum. Unless Bitcoin manages to close daily candles back above $107k, market sentiment is likely to remain cautious.

Featured image from ChatGPT, chart from TradingView.com