A sudden and violent market correction launched by geopolitical striking waves He served as an unprecedented stress test for the whole ecosystem of cryptocurrencies, exposing critical differences in network architecture. While the liquidation event with several billion dollars sent prices that had decreased on everything, Solana showed exceptional resistance, while Ethereum networks and liquidity were shown during the greatest volatility.

Why the high -performance of the solana is still shining

In x publishNasdaq who is on the list of Go -to Solana Digital Asset Treasury (DAT), Defdevcorp, revealed that when the biggest liquidation event is in crypto Last Friday history, most of the markets froze, and Ethereum stumbled. However, Solana did not blink, passing through one of the most disgusting trade sessions ever recorded.

Associated reading

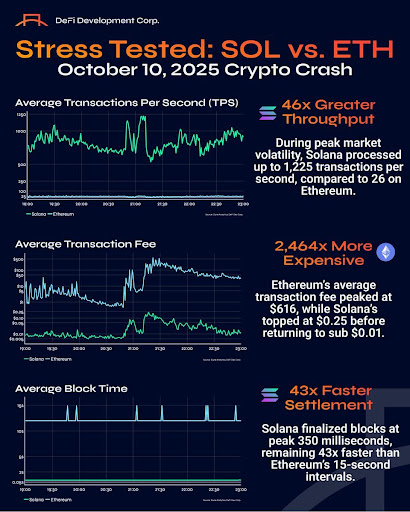

At the height of Volatility, Solana held 1,225 transactions per second, completed blocks in only 350 milliseconds and saw that transactions fees were briefly increased to $ 0.25 before normalizing below $ 0.01. Meanwhile, the Eth Infrastructure stuck below claim While the network fought for processing above 26 TPS. Its block of time extended to 15 seconds, and average gas fees explode to $ 616, effectively locking users and making a chain unusable during the crisis. Eth became unreliable, impractical and effectively unusable during chaos.

As Defidevcorp noted when users are pricing and transactions It cannot be reported, the net could be out of net. In moments of large load, the fundamental promise of blockchain must be retained that will remain affordable, affordable and reliable. However, after almost 20 months of continuous working time, time work, it is profusely clear that salt continued upgrades and optimizations have paid off dramatically.

Defidevcorp has concluded that no other chain is currently approaching the solution of global value transmission on this scale, under such extreme conditions, with the same level of performance. The appearance from the company company is that salt remains only quickly, cheap and usable, even when the global markets are melted.

Why salt price doesn’t match its reliability

Also is the researcher of Alphaplesehq -Ai Advisor and Caminals, Aylo also said That he had assets and decentralized financial (deficit) positions open both on the solana and Ethereum when the crypto market collapsed last Friday. During this time, he had zero problems with the salt network, while the ETH network was unusable due to costs, which often led to market He collapses, Ai Rabby wallet has also fallen.

Associated reading

Aylo added that Eth Maxis should be much angry about the performance of his L1. With this development, salt continues to prove that it is the most reliable and reliable blockchain Under pressure from the real world we have in cryptocurrencies. He pointed out that Sol -‘assessment did not reflect the resistance it proves in the digital world.

Sepaled picture from Adobe Stock, Graph with TraringView.com