Ethereum shows early signs of recovery after a dramatic sale on Friday, which sent prices that have decreased to $ 3,450. The decline came due to what analysts describe as the greatest event of liquidation in the history of cryptocurrencies, deleting billions over positions at their disposal on larger major exchanges. While Bulls briefly lost control during panic, ET has since started stabilized, and the renewed interest in buying has become near the key demand zones.

Associated reading

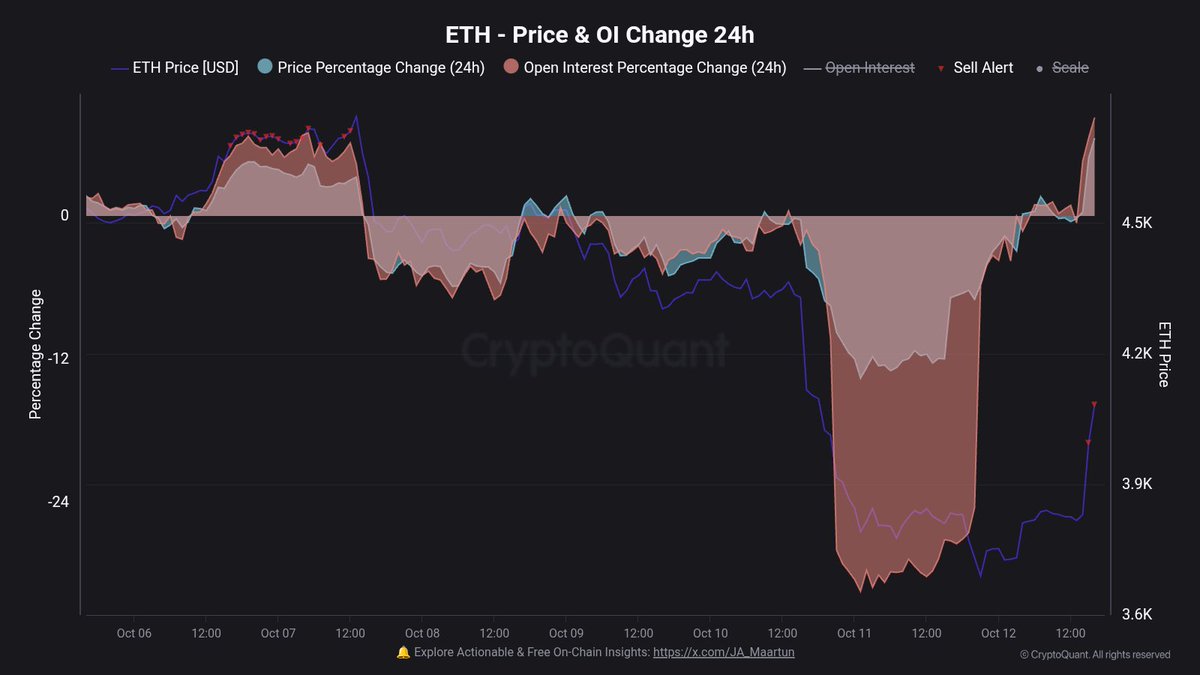

The analyst onchain Maartunn pointed out that the lever is based again on the Ethereum, signaling that traders are returning to the market after resetting. According to his data, the open interest in the ETH has grown significantly in the last 24 hours – a sign that the speculative activity continues with volatility. This renewed influence could set a stage for another decisive move, whether to encourage a short -term relief set or call for further liquidation if the momentum fades.

The following days will be key to Ethereum, as bulls are trying to regain a level of $ 4,000 to confirm a sustainable recovery. The market mood remains cautious but optimistic, with Onchain data showing large owners and institutions continue to accumulate the ETH despite the recent turbulence-poetical signal of long-term trust in property resistance.

Return of a return to Ethereum: a risky renewal in market activity

According to Maartunn, Ethereum’s open interest raised by +8.2% in the last 24 hours – a clear sign that influence returns to the market. This quick increase comes just a few days after the biggest liquidation event in the history of cryptocurrencies, where overwhelmed traders were wiped during a sudden collision. Now it seems that many are trying to “trade their money back”, the kingdom of short -term volatility and guessing during exchange.

Maartunn notes that although these so -called “revenge pump” often create powerful internally sets, they rarely maintain long -term momentum. Historically, about 75% of similar recovery -focused recovery is harder to return, leading to renewed withdrawal after normalization of liquidity and financing rates. Only about 25% manages to expand to permanent upgrades, usually when supported by fresh purchases or renewed institutional inflows.

These data emphasize the uncertain balance of the Ethereum that is currently facing. Open -interest signals have revived market participation, but also brings the risk of another wave of forced liquidation if traders exaggerate in their positions. For the time being, the ETH recovery is a great extent to the ETH recovery, fueled by the activities of the derivative, not on the face of demand.

For the next few days it will be crucial in determining the direction of Ethereum. If the price is held above the region of $ 4000 with sustainable volume, it could confirm that the bulls restore control. However, a sudden drop in open interest or sharp spikes of funding could signal that the rally increases – setting the stage for another correction.

Associated reading

Ethereum refuses, but resistance is ahead

Ethereum shows a solid recovery after last week’s dramatic sale that reduced prices to a level of $ 3,450. The daily chart shows that ETH quickly bounced off the 200-day moving average (red line), confirming it as the main area of demand. The price is now consolidated close to $ 4,150, trying to build a momentum after a strong bull candle on a large amount – a potential sign that customers restore control.

However, ETH faces immediate resistance near the zone of $ 4,250 to $ 4,300, which coincides with the 50-day moving average (blue line). This area had previously acted as a strong support, and it would be key to confirmation of the transition to the bull structure. The 100-day moving average (green line) is now flattened, which reflects the caution mood of the market after a massive liquidation event.

Associated reading

If Bulls manages to maintain a price above $ 4,000, the following goals lie close to $ 4,500 and at the end of $ 4,750. In contrast, a 200 -day holding failure could open the door with deeper testing of $ 3,600 or lower. For now, the recovery of Ethereum remains technically constructive, but it must overcome these resistance levels to confirm that the recent aversion is more than just a short -term reaction to the overdled conditions.

Sepaled picture with Chatgpt, a graph with a traditionview.com