Bitcoin traded just over $ 121,000 on Wednesday, holding the gains after falling from a recent top above $ 126,000. According to an analyst, EGRAG CRYPTO, a small market move could start a much larger set, upgrading on a sample he says he has repeated himself in past cycles.

Associated reading

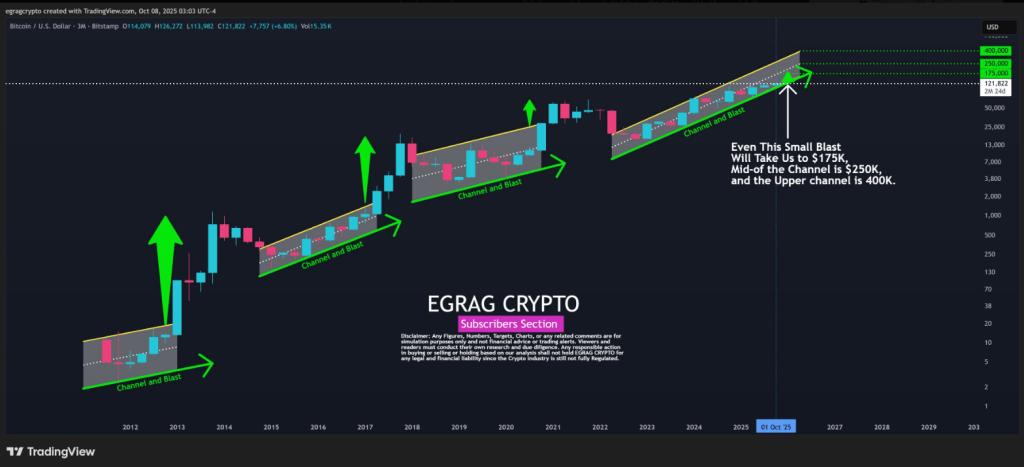

Historical breakthrough of channels

EGRAG’S LOOK is based on a three -month view of the channels of prices that, they argue, preceded large gatherings. Based on the report, similar to the channel breakthroughs were visible before the 2013 rise to around $ 1,163, 2017 increased $ 19,000 and a 2020-2021 set that pushed prices above $ 69,000.

He says the current channel began to form in April 2022 and that a modest “flash” could push Bitcoin to $ 175,000. This goal should approximately 43% increase with $ 122,620. The short -term swings ranged from 115,000 to $ 125,000 this week, while the current price is close to $ 121 900.

#Btc – $ 175k is just a piston:

If we look at historical behavior #Btc On a 3-month time frame we can see a clean canal formation. In the last three cycles we have consistently seen a breakthrough at the end of these channels. Although the reduced yields are visible, they are … pic.twitter.com/tabfovlxbt

– EGRAG CRYPTO (@EGRAGCRYPTO) 8. October 2025

Goals and risks for viewing

EGRAG emphasized a number of possible outcomes. He put $ 175,000 as the main goal. He also suggested a middle point close to $ 250,000 and an upper scenario about $ 400,000. These are ambitious numbers. They were presented as part of a long -term view, not the promise of the immediate move.

The analyst compared his invitation to Bitcoin with the last golden forecast – he set a goal of $ 3,500 for gold, which later prices recorded close to $ 4,000 – using it as a reference for his prediction access.

At the same time, the data on the chain offers a mixed image. Blockchain analytics firm glass glass reported That 97% supply of Bitcoin is now incorrect after a recent gathering.

This high level of realized profit suggests that many owners sit above their purchase price. Some analysts interpret elevated profit as a sign that markets can pause so investors can use the gain.

Associated reading

Others indicate overcrowded positions and growing levers as signs that short -term volatility could increase. Reports have revealed concerns about some calling “Sit for Sisa”, which is a jump that tempts late customers and follows a fall.

Market behavior and investors’ moves

The accumulation is visible in many wallets. Some investors have redistributed gain, not to sell out completely, which, according to reports, may indicate a controlled rotation of capital, not a panic sale.

A separate picture from Pixabaya, a graph from TraringView