Since Bitcoin (BTC) continues to record new maximums of all time (ATH), the focus returns to key prices levels that could provide investors with the idea of the following possible resistance levels that could see a sale in BTC. Fresh data on the chain offer a map of the most important BTC prices.

Bitcoin can face resistance to these levels

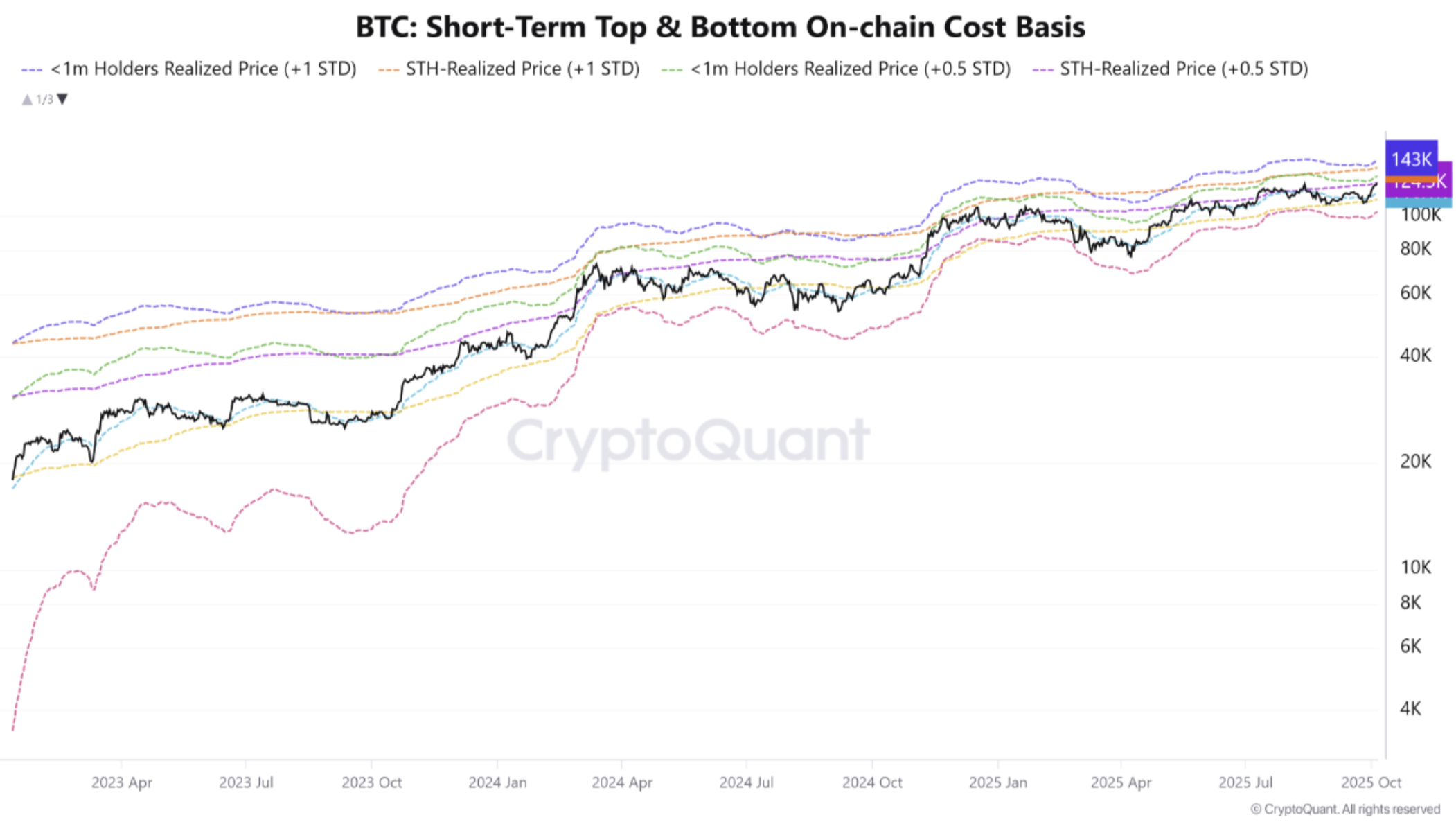

According to Cryptoquant Quicktake to Post by Crazzyblockk associates, the basis of the cost (the realized price) of the BTC short-term owners (SD) provides a recording of important support and resistance zones.

Associated reading

It is significant that the STH realized price emphasizes the total price that the recent participants in the market have acquired their BTC. This information can provide analysts with the idea of potential prices levels that may affect investor behavior or to take profit or retain their positions.

Crazzyblockk has highlighted several levels of prices that could function as potential profit taking zones. For example, <1 -month owners have achieved a price, +1 standard deviation, hovering at $ 143,170.

To explain, $ 143,170 is a price level at which recent customers (holding BTC in less than a month) would increase on average by approximately one standard deviation from their costs that can start sales and serve as a short-term resistance.

Similarly, owners of 1 month have realized the price, 0.5 standard deviations, currently amounts to about $ 133,239. Meanwhile, the price of a sth-recalled, +1 standard deviation, is currently $ 131,310.

The analyst added that the current price of the BTC traded slightly above the “main environment” level, which could determine the next short-term move on the market.

In addition, Cryptoquant associate noticed multiple key support zones that could function as potential re -respective battery zones for BTC investors. These levels include $ 117,763, $ 111,963 and $ 103,239.

Fellow crypto analyst, Titan from Cryptoa, noted that BTC made a a New ATH Above $ 125,000 must now be pierced above the ascending channel and aiming at a goal of $ 130,000. Failure to break through could lead to the correction of prices for a crypto currency.

Potential BTC goals?

While some colors analysts that BTC is close to surpassing this market cycle, others are relatively optimistic. For example, an experienced crypto analyst Ali Martinez predicts That BTC can reach $ 140,000 based on price range.

Associated reading

Similarly, crypto analyst Alex Adler Jr. forecast That BTC can increase as much as $ 160,000 if two key conditions are fulfilled. Improve, spending BTC reserves for cryptocurrencies can accelerate the trajectory of digital assets.

Finally, if Bitcoin follows his trajectory from the market cycle 2021, then he could goal At least $ 136,000, with an extended goal of $ 147,000. At the time of the press, the BTC traded in the amount of $ 122,113, which is lower by 2.2% in the last 24 hours.

Sepaled image Unsplash, Cryptoquant and TraringView.com chart